|

|

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Up 15% in 3 Months, Is It Too Late to Buy DraftKings Stock?

Shares of gaming platform firm DraftKings Inc. (DKNG) have gained 15% over the past three months, indicating positive market sentiment. Highlights in the company’s current market position include the optimism regarding online legal sports betting. Now, a majority of U.S. states have legalized the activity, which creates a long runway for companies like DraftKings. The company is also showing operating efficiency through growing financials. So, should investors take a bet on DraftKings now? About DraftKings StockFounded in 2012 and headquartered in Boston, Massachusetts, DraftKings is a popular digital sports and gaming platform company that offers its customers a suite of real-money experiences. The company provides daily fantasy sports (DFS), mobile and retail sports betting, and online casino gaming. The company also designs, develops, and powers sportsbooks and iGaming services across the U.S. and international markets. The company’s platform enables users to draft fantasy teams, bet on live sports events, and play casino games, including blackjack, roulette, and slots. DraftKings currently has a market capitalization of $38.3 billion. DKNG stock has been performing well recently, particularly after its solid second-quarter earnings. Over the past 52 weeks, the stock has gained 37.5%. It reached a 52-week high of $53.61 in February. This year, it is up by 16.21%. Just for comparison, the broader S&P 500 Index ($SPX) has gained 9.62% over the same period.

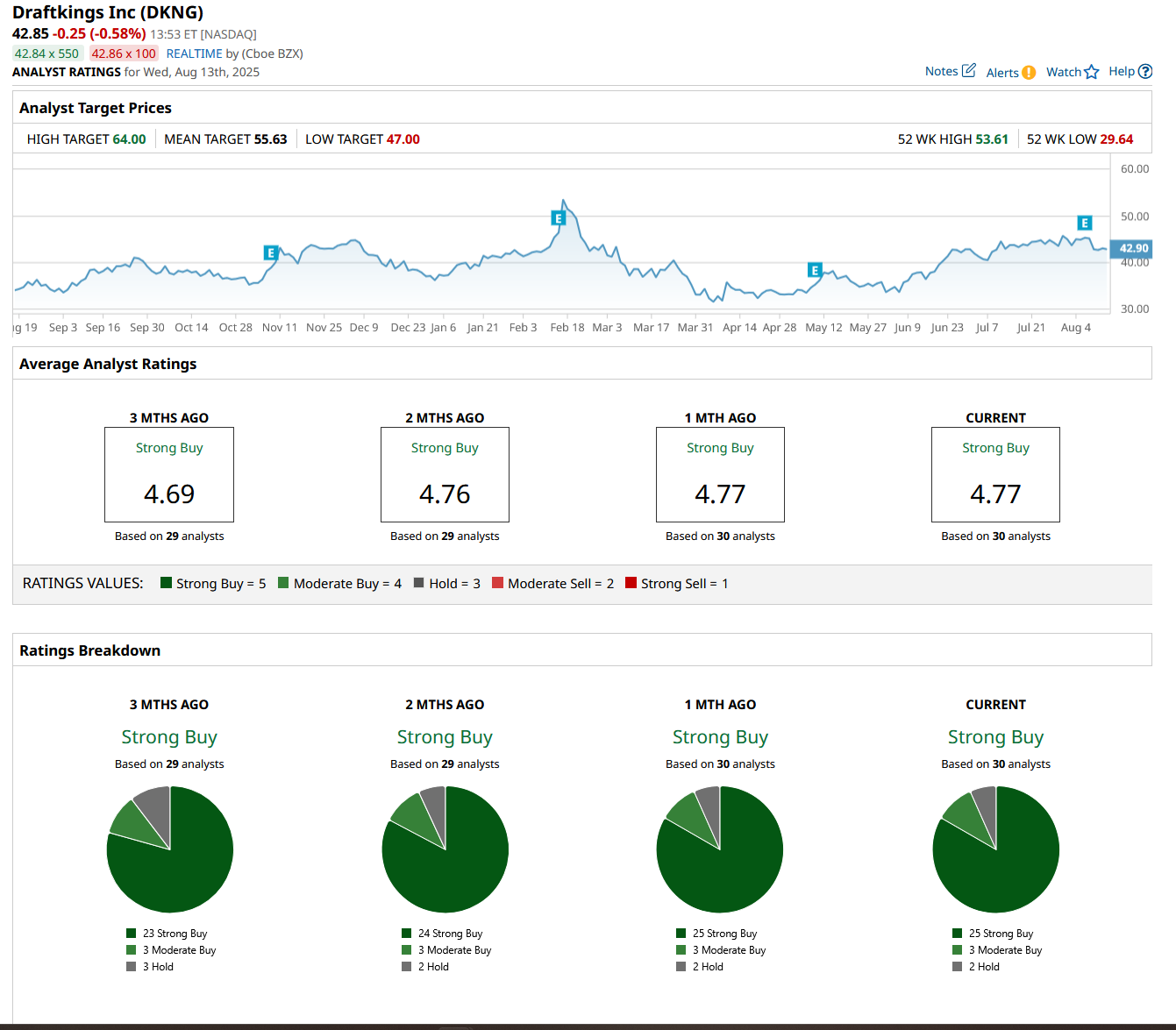

However, the company’s valuation is currently at an eye-watering level. Its forward price-to-earnings ratio sits at 100.56 times, which is significantly higher than the industry average of 18.54 times. DraftKings Recorded Robust Financial Growth in Q2On Aug. 6, DraftKings reported solid second-quarter results for fiscal 2025. In that, the company’s operations were fueled by strong customer retention. Its monthly unique payers (MUPs) increased by 6% year-over-year (YOY) to 3.30 million, while average revenue per MUP increased by a robust 29% to $151. DraftKings’ operational gains indicate strong unique payer retention and a slew of acquisitions across the company’s Sportsbook and iGaming segments, as well as its purchase of digital lottery app Jackpocket. DraftKings has successfully implemented its strategy to increase its customer base by optimizing marketing costs. Revenue increased by 37% from the prior year’s period to $1.51 billion. This figure exceeded the $1.43 billion that Wall Street analysts had expected. Besides substantial customer acquisition and engagement, revenue growth was also harnessed by a higher structural sportsbook hold percentage. The company reported $0.30 in GAAP EPS, up 200% YOY, and adjusted EPS of $0.38, up 73% from its year-ago value. However, its bottom-line figure was lower than the $0.41 that analysts were expecting. DraftKings also pointed towards further robust growth for this year. It is reportedly in talks to acquire the regulated prediction market platform Railbird, which enables users to trade contracts on real-world events, including economic indicators, weather patterns, and sports outcomes. There is also a helpful provision for the company in President Trump’s “One Big Beautiful Bill” that changes tax laws to allow gamblers to deduct only 90% of their losses (as opposed to the previous 100%). This primarily affects professional gamblers, who essentially cut into DraftKings’ profits. DraftKings maintained its fiscal 2025 revenue guidance range of $6.20 billion to $6.40 billion, which indicates a 32% YOY growth. The company expects to deliver revenue closer to the high end of this range, driven by its sportsbook-friendly outcomes, as well as other revenue drivers. Wall Street analysts are highly optimistic about DraftKings’ future earnings. They expect the company’s loss per share to narrow by 78.3% YOY to $0.13 for the third quarter. For the current fiscal year, EPS is projected to surge 158.1% annually to $0.61, followed by a 136.1% growth to $1.44 in the next fiscal year. What Do Analysts Think About DraftKings Stock?Wall Street analysts are soundly bullish on DKNG stock. Recently, analysts at Jefferies raised the price target from $53 to $54, while maintaining their “Buy” rating on the stock. The company’s strong Q2 results were cited as a reason. The analyst firm also pointed out the upcoming football season as a possible tailwind. The company is also facing easier comparisons due to its previous low-holds. Barclays analyst Brandt Montour raised the price target on DraftKings from $51 to $54, while keeping the “Overweight” rating on the company’s shares, which indicates a generally positive outlook on the stock. In addition, Benchmark analyst Mike Hickey maintained his “Buy” rating on the company's shares, while raising the price target on the stock from $50 to $53, reflecting a positive sentiment on the stock’s prospects. DraftKings has come under the spotlight on Wall Street, with analysts awarding it a consensus “Strong Buy” rating overall. Of the 30 analysts rating the stock, a majority of 25 analysts have rated it a “Strong Buy,” three analysts suggest a “Moderate Buy,” while two analysts are playing it safe with a “Hold” rating. The consensus price target of $54.77 represents a 27.7% upside from current levels. The Street-high price target of $64 indicates a 49.3% upside.

Key TakeawaysWith the possibility of increasing legalization, continued customer acquisition, and efficiency gains, DraftKings’ prospects appear bright. Moreover, despite the high valuation, analysts expect its stock price to rise. Therefore, DKNG stock may be a sound investment at this time. On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|