|

|

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Seagate Stock Skyrockets 80% in 2025. Here’s Why STX Might Still Be a Steal/Seagate%20Technology%20Holdings%20Plc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

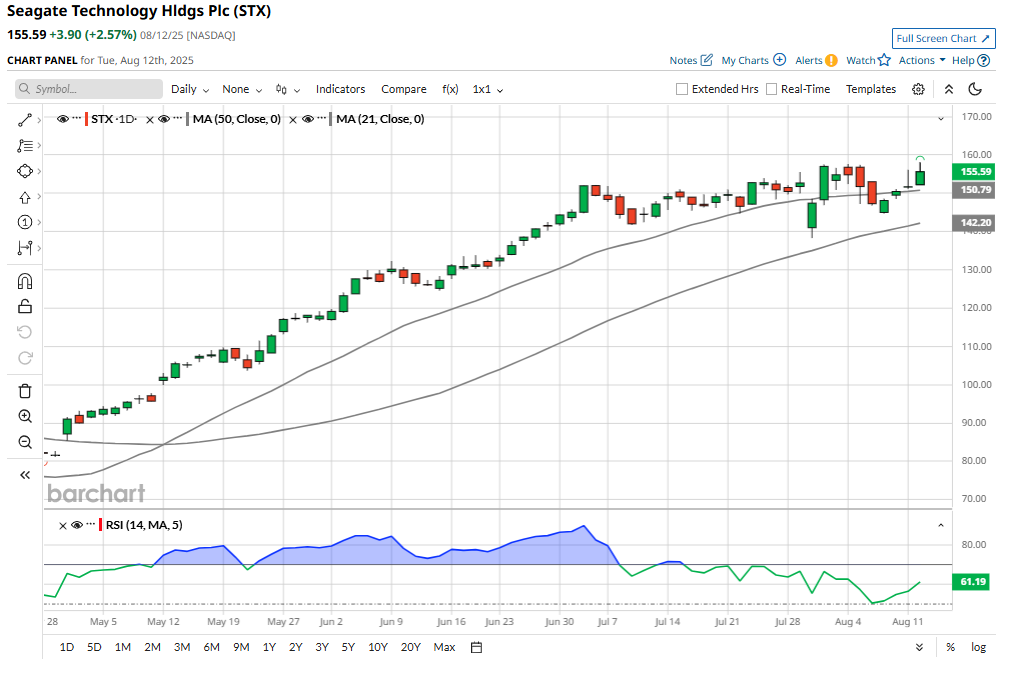

Seagate Technology (STX) has been one of the top-performing S&P 500 Index ($SPX) stocks of 2025. It has soared over 80% year-to-date. This significant rally is supported by the solid demand for the company’s products, increased investments in artificial intelligence (AI) infrastructure, its improving leverage profile, and improved profitability. Seagate is seeing surging demand for its mass-capacity storage products. As cloud computing expands and data centers scale up to support AI applications, the demand for high-capacity hard drives continues to soar. Seagate is well-positioned to capitalize on this opportunity. Its products have become essential for hyperscale cloud providers and enterprises alike, making it a natural beneficiary of the AI-driven data explosion. The company’s financials reflect the solid demand trends. Seagate recently closed fiscal 2025 on a solid note. Revenue surged 39% in fiscal 2025, adjusted gross profit nearly doubled, and operating profit more than tripled. This solid performance is driven by its supply-demand alignment, tight cost controls, and a focus on high-value products. Quarterly performance has been just as impressive. In the most recent fiscal fourth quarter, revenue jumped 30% year-over-year, while adjusted gross margin expanded 170 basis points sequentially. This sustained improvement reflects the company’s shift toward a build-to-order (BTO) manufacturing model, supply discipline, and dynamic pricing strategies, all of which have helped the company maintain profitability even in competitive markets.

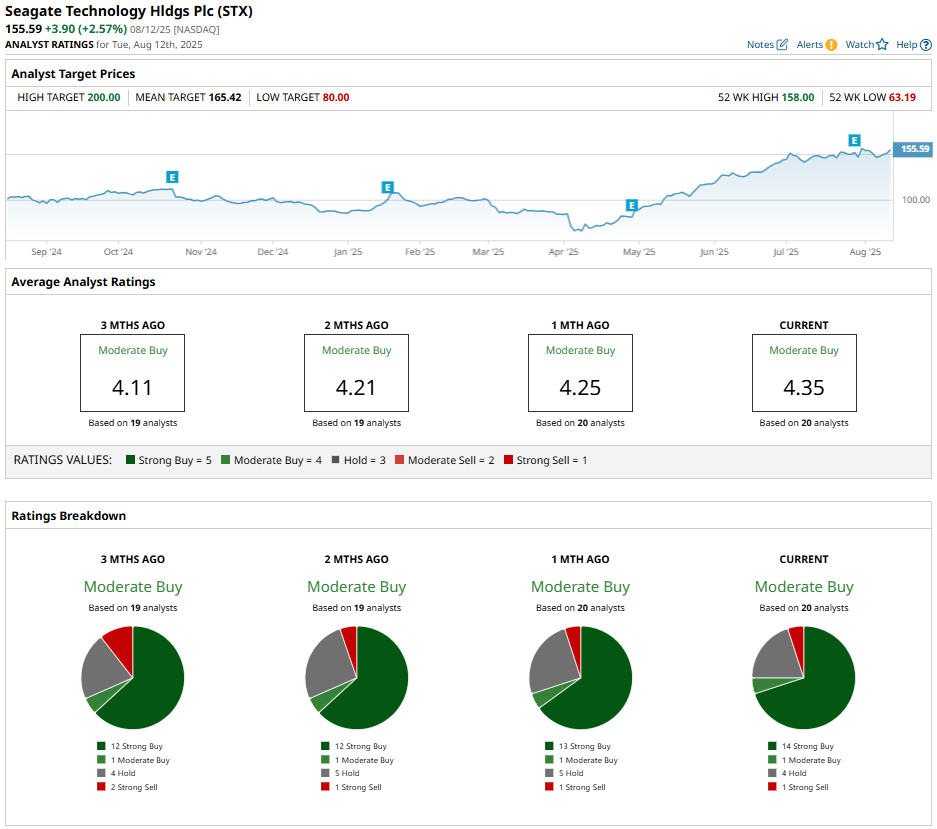

Seagate Is in a Solid Growth PhaseSeagate is in a solid growth phase, with no signs of losing momentum. It continues to see strong demand for its products, a trend that is expected to drive both its financials and share price higher. Management is optimistic about margin expansion, thanks to the accelerating adoption of its next-generation Heat-Assisted Magnetic Recording (HAMR)–based Mozaic drives. Looking ahead, mass capacity storage remains a key growth driver. Seagate is ramping production of its HAMR-based Mozaic products and gaining traction with customers at an impressive pace. Three major cloud service providers have already qualified these drives, with more customers moving through the qualification process smoothly. Demand from cloud providers is surging, and even the enterprise OEM market is showing signs of life, with nearline sales posting modest sequential gains. Management expects this demand to hold steady in the months ahead. The company’s BTO strategy provides visibility into solid future sales and margins, strengthening confidence in ongoing demand for its high-capacity nearline drives. Seagate is also navigating global challenges well. By diversifying its manufacturing footprint and supply chains, Seagate is mitigating risks from evolving trade policies and tariffs, minimizing any potential impact on operations or results. Financially, Seagate is also making meaningful progress in fortifying its balance sheet. As of the end of June, the company had reduced its debt to $5 billion. Strong profitability combined with lower debt has brought its net leverage ratio down to 1.8 times. With profit expansion expected in the coming quarter, further improvement in leverage is on the horizon. STX Stock Looks Attractive on ValuationSeagate stock has appreciated significantly so far this year. However, it offers significant value near the current price levels. The company is poised to benefit from the strong long-term demand for mass data storage, driven by cloud providers and edge IoT customers ramping up investments in AI-powered initiatives. Despite these tailwinds, STX shares remain relatively inexpensive. Currently, Seagate is trading at a forward price-earnings ratio of just 16.8x. The stock looks too cheap to ignore, considering its growth prospects. Analysts project earnings per share (EPS) to jump by 24.1% in fiscal 2026 and another 29.4% in 2027, suggesting that the market may not yet be fully pricing in Seagate’s potential. STX Stock Is a Steal Right NowSeagate’s remarkable surge in 2025 has kept analysts cautiously optimistic about its prospects. However, strong demand for its high-capacity storage products, growing traction for HAMR-based Mozaic drives, a healthier balance sheet, and low valuation could keep Seagate’s momentum going.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|